Baptiste Maury

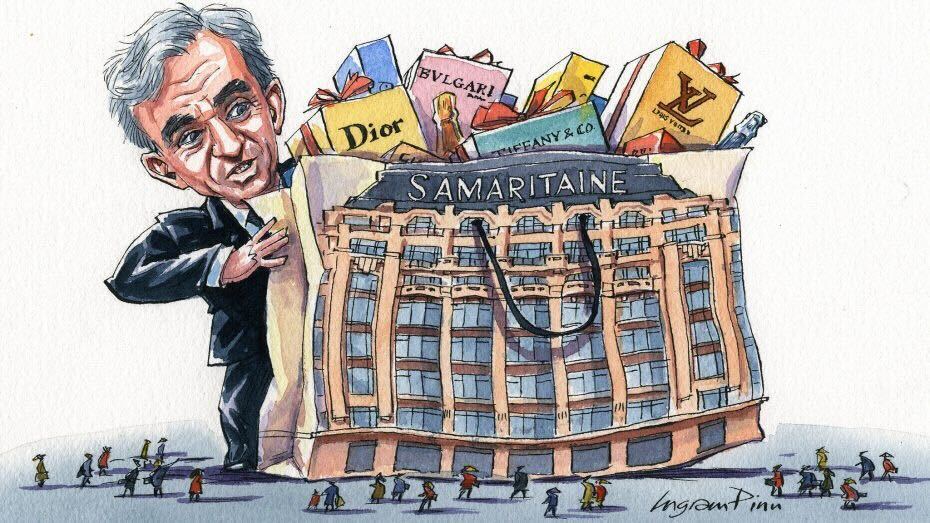

The world of luxury goods is a majestic arena where the finest brands compete for the hearts and wallets of discerning consumers. Two giants loom large in this realm of artistic innovation and boundary-pushing creativity: LVMH and Richemont. Rumours swirl of a potential acquisition of Richemont by LVMH, but such a move would not come without its risks.

Many see Richemont’s potential acquisition by LVMH as a daunting prospect for the industry. While this may seem like a straightforward business move on the surface, it carries the potential for a seismic shift in the industry’s landscape. The consolidation of two powerful entities would create a near-monopoly, and it is essential to consider the impact such a development could have on the industry’s diversity and creativity. Although LVMH and Richemont do not compete in the same luxury areas (Richemont primarily specializes in high-end watches, and LVMH specializes in fashion, cosmetics, and spirits), these two behemoths command a significant share of the luxury goods market. Such an acquisition would ultimately result in a concentration of power and annihilation of competition. This fear has long troubled French economist Frédéric Bastiat as he once wrote, “Détruire la concurrence, c’est détruire l’intelligence.” An acquisition of this scale could lead to an abuse of that power, harming the entire fashion luxury industry and, ultimately, its competitors and consumers alike.

One of the main concerns associated with such a monopoly would be a complete homogenization of the brands’ strategies and identities. Nietzsche once said, “A thousand goals have there been so far, for there are a thousand peoples.” Indeed, the fashion luxury industry has long been characterized by a rich tapestry of diverse artistic visions, each striving to distinguish itself in a crowded and competitive field. From the exuberant prints of Missoni to the sleek minimalism of Jil Sander, from the boldness of Gucci to the elegance of Chanel, fashion houses have long relied on their unique identities to set them apart. However, the potential acquisition of Richemont by LVMH could upset this delicate balance, resulting in a homogenization of the industry. This potential monopoly could dangerously stifle creativity and discourage innovation as brands would end up under the same umbrella and same vision. Rather than fostering competition between brands, it could result in a narrowing of views and a loss of the vibrancy that has long characterized the fashion industry. This could lead to a loss of the unique identities that each brand has worked so hard to cultivate. Rather than celebrating the individuality and creativity of each house, the industry could become dominated by a few monolithic entities, leading to a lack of differentiation and ultimately to a loss of consumer interest.

Furthermore, LVMH’s predatory acquisition strategy raises concerns regarding its vision for the fashion industry. Indeed, in the luxury fashion industry, brands compete for the hearts and wallets of discerning consumers. However, LVMH, as a conglomerate that owns several high-end fashion brands, neglects the heart of fashion by prioritizing profit over creativity and artistic expression. In their pursuit of commercial success, LVMH is more focused on catering to the tastes and desires of their consumers rather than pushing boundaries and taking risks that could lead to groundbreaking designs and concepts. As a result, some critics may accuse LVMH of neglecting the heart and soul of fashion in favour of maximizing profits and market share. Recently, the collaboration between Tiffany & Co. and Nike has received severe backlash as people have considered it to be an example of “brand dilution.” Such an unusual pairing between a luxury jewelry brand and a sportswear giant is most certainly more driven by commercial interests than creative synergy. Following the recent appointment of Pharrell Williams as Creative Director of Louis Vuitton, could one imagine a potential collaboration between Billionaire Boys Club and Cartier if LVMH’s acquisition of Richemont were to go through?

The potential acquisition of Richemont by LVMH poses a clear threat to the fashion luxury industry, and it is essential to consider the impact of such a development. Rather than celebrating diversity and individuality, it could lead to a homogenization of perspectives, stifling creativity and discouraging innovation. As philosopher Gilles Deleuze said, “The question is not only what is happening, but what can be created in the place that is opened up by the breach.” It is up to those in the industry to ensure that the breach remains open, allowing for a continued celebration of diversity, creativity, and innovation in the fashion luxury industry.