Written by Thelma Gauthier

Edited by Leah Gilbert

Polène is generating both excitement and debate with its rapid ascent to acclaim, opening of flagship stores in New York, Paris, and Tokyo, and its announcement regarding potential ties with the prestigious LVMH group. But what truly defines the brand’s quality, and what controversies linger beneath its meteoric rise? Polène emerged from a rich legacy of leather craftsmanship It was founded in 2016 by siblings Elsa, Antoine, and Mathieu Mothay in Paris, drawing from their family’s story and expertise for inspiration.

The Bags

From the beginning, the brand has emphasized high-quality leathers, sourced from tanneries in Ubrique, Spain, the same suppliers for renowned luxury houses like Céline. Polène aims to distinguish itself with careful attention to detail, particularly in its iconic Cyme bag, which features contrasting topstitching. This design element is associated with established luxury houses like Hermès, especially their Kelly bag, where the visible stitching has become a signature feature of the product’s identity. Polène employs a topstitching technique wherein they craft their bags inside out before turning them right-side out to intentionally expose the bag’s stitching. This method not only reflects Polène’s commitment to craftsmanship but also aligns with the desired aesthetic tradition of iconic luxury brands, showcasing how Polène wants to be perceived: as refined design.

Additionally, the structural integrity of the bags is key, with a focus on leather malleability. The Cyme bag also offers versatility in its design; it can be made in different sizes depending on how the outer parts of the bag are folded inward. One shape resembles a trapezoidal silhouette, while the other takes on a more rounded, pouch-like appearance, similar to a drawstring bag. Recently, Polène has introduced a playful yet elegant twist on the design with a new bag, seemingly inspired by Bottega Veneta’s distinctive woven leather designs. The brand once again showcases its ability to stay relevant while adding fresh elements to its collections.

The Financial Weight?

Polène – now valued close to a billion euros – has quickly solidified its place in the fashion world, expanding beyond its origins into high-end costume jewelry. The brand’s design philosophy is characterized by simplicity, favouring minimalist colours and elegant, refined shapes that convey an air of timeless sophistication. Their bags are crafted to suit a variety of daily needs, blending functionality with style and making them suitable for multiple occasions.

With a price range of 300-400 euros, Polène’s bags position themselves within the mid-range market, comparable to brands like Coach or Kate Spade, but with a more sophisticated image. This strategic positioning has been key to the brand’s rapid success, especially as it has gained visibility through its feature in the popular series Emily in Paris by Darren Baker, or even on Kate’s Middleton shoulder.

The timing of Polène’s rise has been perfect, aligning with broader fashion trends that favour minimalism and timeless designs. As these values continue to resonate with a growing global audience, Polène’s reach has expanded, captivating not only fashion-forward individuals but also those seeking accessible luxury fashion that transcends fleeting trends. The combination of strategic design choices and effective branding has enabled Polène to capture the attention of an increasingly international clientele.

Polène’s meteoric rise in the fashion world has been marked not only by its design and marketing success but also by its strategic financial backing. More precisely, Polène was acquired by L Catterton, an investment fund connected to LVMH, which purchased shares from Polène’s previous investment fund, Edouard Sterin’s Otium Capital. This distinction is important; Polène is not part of the LVMH group in the same way as Dior, for example, but rather falls under the partial ownership model, similar to LVMH’s investment in Hermès. That is still a pivotal move for a brand that was relatively unknown less than a decade ago.

Now valued at close to a billion euros, Polène has quickly solidified its place in the fashion industry. Building further on Polène’s growth trajectory, it’s important to note that L Catterton – the investment fund behind the brand’s acquisition – has shown interest in similar emerging labels that, like Polène, occupy a space in between mainstream and high-end luxury fashion.

A Unique Strategy?

While the prices remain mid-range, Polène is attempting to project and make itself perceived as a super-luxury brand, creating a potential trap. The brand aims to project an image of high-end craftsmanship, but customers have found that the quality doesn’t live up to the elevated expectations set by their marketing. Instead, what they receive is more in line with mid-range quality, which is what should be expected from the actual brand’s positioning. This customer experience can feel somewhat contrived; long lines and hype around brands are reminiscent of the exclusivity often associated with true luxury labels.

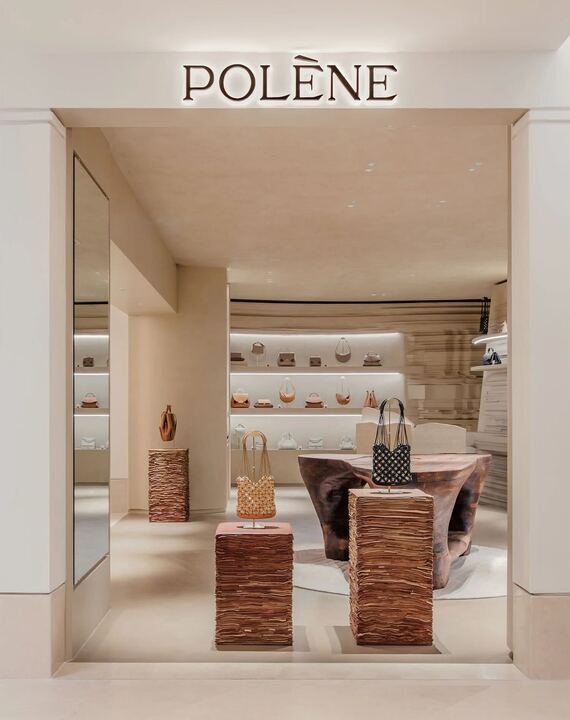

However, Polène’s boutiques feature sparse displays, and the sales assistants, though well-intentioned, are evidently trying to emulate that same luxury atmosphere. While they work to create a polished experience, it sometimes feels out of sync with the reality of the product, leaving customers to question whether the brand’s pricing strategy is simply capitalizing on perceived luxury.

This is one way to see it, but in fact, if we take a closer look at Polène’s strategy, we see that the brand is not aiming to become a true luxury label. Most true luxury brands have been firmly established for decades, and displacing them would be extremely difficult. Moreover, purchasing power around the world is on the decline, making luxury goods increasingly difficult to obtain for the average consumer.

Considering these factors, Polène’s marketing approach could be seen as a stroke of genius. By positioning itself in department stores alongside brands like Loro Piana, Polène is leveraging luxury codes without necessarily becoming a part of the luxury market itself. The brand uses luxurious displays and premium positioning, but it doesn’t carry the same prices as the high-end competitors.

This raises the question: Is Polène manipulating luxury codes and offering a poor imitation, or is it actually executing a well-thought-out strategy that has proven successful? Polène seems to be riding the wave of evolving consumer habits, where high-end aesthetics are valued but luxury is becoming less attainable for many. The brand seems to be filling a niche: offering a luxurious image with attainable pricing, capturing the desire for sophisticated design without the steep price tag associated with traditional luxury.

In this context, the brand’s approach may not just be a clever manipulation of luxury standards, but a calculated response to market trends, positioning itself as a smart alternative in a changing economic landscape.